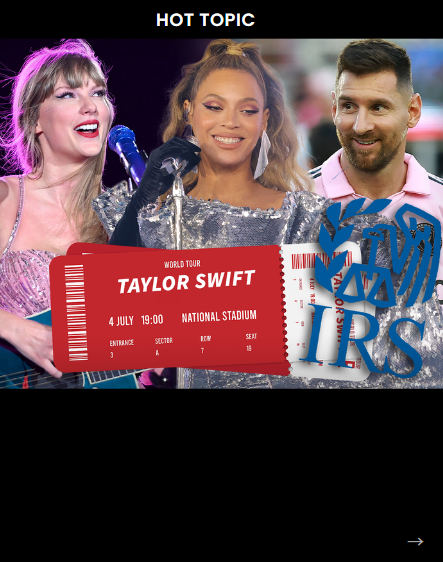

The IRS has implemented new rules that will impact ticket resellers who made substantial earnings from hot concerts and sporting events such as Taylor Swift, Beyoncé, and Lionel Messi’s games in Miami. According to the updated 1099-K form regulations, individuals who sold more than $600 worth of tickets on platforms like StubHub and Ticketmaster this year are now required to report these earnings as taxable income.

The 1099-K form focuses on payments received through credit and debit cards, gift cards, and transactions on third-party payment networks and online marketplaces—making it applicable to Ticketmaster and StubHub transactions.

Ticket resellers have seen substantial profits this year, capitalizing on events like Taylor Swift’s Eras Tour, Beyoncé’s Renaissance Tour, and even Lionel Messi’s soccer matches, where tickets were often resold at significantly higher prices.

While some may view this as an additional financial burden imposed by the IRS, others see it as a form of justice, ensuring that those who paid exorbitant prices for tickets from scalpers are not left in the lurch.

Written by:

Dana Sterling-Editor